does texas have a death tax

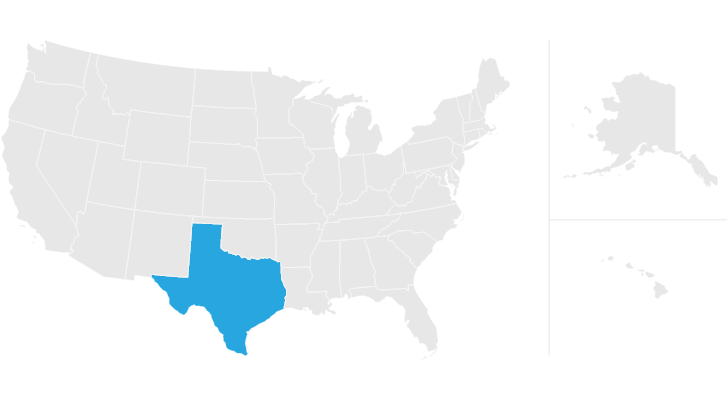

For amounts over 1 million those funds will be taxed at a rate of 40. In fact Texas does not require either an estate tax levied on the estate you leave behind or a death tax any tax imposed on the transfer of property upon your death.

Texas Estate Tax Everything You Need To Know Smartasset

What are the state and federal tax consequences of a Texas TODD.

. If you have an estate that is big enough. Texas does not have an estate tax either. No estate tax or inheritance tax.

On the low end of the scale the rates are 18 for taxable amounts less than 10000. Live Call Answering 247. Transfer on death deeds legal in texas since 2015 have been heralded as the latest greatest method for keeping real property out of probate.

This means that any estates that are valued over 117 million dollars will be taxed before any assets are transferred to the heirs. Transfer on death deeds legal in Texas since 2015 have been heralded as the latest greatest method for keeping real property out of probate. Call or Text 817 841-9906.

Prior to September 15 2015 the tax was tied to the federal state death tax credit. It is a transfer tax imposed on the wealthy at death. Federal estate taxes do not apply to most people.

Texas has no individual income tax as of 2021 but it does levy a franchise tax of 0375 on some wholesalers and retail businesses. A person who died in 2016 will only have estate taxes if the estate is worth more than 549 million. The goal behind them is.

No there is currently also no inheritance tax in Texas for. Talking Taxes Estate Tax Texas Agriculture Law Texas Longhorns University Mark Poster Zazzle Com In 2022 University Of Texas University Texas Logo. Texas does not have an estate tax either.

No estate tax or inheritance tax. Texas is one of the states that do not collect estate taxes. 71 million Estate tax rates.

The difference between the inheritance and estate taxes is the fact that the latter applies to the estate of the recently deceased before the assets are transferred to the heir. Tax was permanently repealed effective as of September 15 2015 when Chapter 211 of the Texas Tax Code was repealed. UT ST 59-11-102.

However localities can levy sales taxes which can reach 75. The entire death row inmate roster in the state. In fact only New Jersey Nebraska Maryland Kentucky Iowa and Pennsylvania collect estate taxes.

The higher the value of the estate the higher the tax rate you will pay. At the Federal level the tax rates exist on a sliding scale similar to income tax rates. Alaska is one of five states with no state sales tax.

Intestate succession laws affect only assets that are typically covered in a will specifically assets that you own alone like real estate stock market investments businesses and other types of physical. Yes Estate tax exemption level. Does texas have a death tax Friday July 1 2022 Edit.

No estate tax or inheritance tax. Texas also does not have an. Texas does not have state estate taxes but Texas is subject to federal estate taxes.

108 - 12 Inheritance tax. While Texas doesnt have an estate tax the federal government does. This was the first execution in the state of Texas since 1964.

No Inheritance tax rates. The federal estate tax disappears in 2010. If you die with a gross estate under 114 million in 2019 no estate tax is due.

Call or Text 817 841-9906. The top estate tax rate is 16 percent exemption threshold. The top estate tax rate is 20 percent exemption threshold.

What Is The Probate Process In Texas A Step By Step Guide. A transfer on death deed has no legal effect during the owners life so state ad valorem property tax exemptions are not affected. While Texas does not impose a state inheritance or estate tax if you die without a will your assets will be distributed through the states intestate succession process.

There is a 40 percent federal tax however on estates over 534. Texas does not have an inheritance tax meaning no death-related taxes are ever owed to the state of Texas. The only types of taxes that apply in Texas after a person dies are income taxes gift taxes property taxes and federal estate tax.

Higher rates are found in locations that lack a property tax. Additionally the state no longer has an inheritance tax which means that if your loved ones inherit from you they will not be taxed on the assets they receive. If your gross estate is over 114 million you pay a.

There is a 40 percent federal. Tax is tied to federal state death tax credit. Since 1976 the state of Texas has executed 561 offenders with capital punishment up until April 2019.

Property conveyed by a Texas TODD is treated the same as probate property so beneficiaries receive a stepped up federal basis. The last inmate that was executed was John William King on April 24 2019. Texas is the second-most populous state within the Union.

Does Texas Have Its Own Estate Tax. Texas does not have an inheritance tax meaning no death-related taxes are ever owed to the state of Texas. So a married couple gets two step-ups one at the time of the first spouses death and another at the time of the second spouses death.

However there is still a federal estate tax that applies to all property that exceeds the 1206 exemption bar if a person has deceased after January 1 2022. If your gross estate is over 114 million you pay a tax on the overage. No estate tax or inheritance tax.

600 AM on Feb 9 2020 CST.

Ut Tt Poll Texans Stand Behind Death Penalty The Texas Tribune

What Is The Probate Process In Texas A Step By Step Guide

Texas Inheritance And Estate Taxes Ibekwe Law

:watermark(cdn.texastribune.org/media/watermarks/2012.png,-0,30,0)/static.texastribune.org/media/images/UT-TT-Poll-Thurs-LifeDeath-.128.png)

Ut Tt Poll Texans Stand Behind Death Penalty The Texas Tribune

Real Estate Exam Cheat Sheet Real Estate Exam Real Estate Forms Real Estate Test

Texas Inheritance Laws What You Should Know Smartasset

Como Puedo Probar La Herencia En Texas Tax Protest Protest Property Tax

Texas Estate Tax Everything You Need To Know Smartasset

Texas Inheritance Laws What You Should Know Smartasset

Https Irsprob Com Irsprob Com Wins Again 2 Internal Revenue Service Cpa Irs